Looking for a SIP SWP Calculator with Inflation and Tax in India ? This tool helps you plan real mutual fund returns, adjusted for both inflation and capital gains taxes built especially for Indian investors. When it comes to long term financial planning, it’s not just about saving and investing it’s about withdrawing wisely too. That’s where a SIP SWP Calculator with Inflation and Tax becomes a powerful tool in your financial journey.

Whether you’re starting with a Systematic Investment Plan (SIP) to build your wealth or planning a Systematic Withdrawal Plan (SWP) to generate monthly income during retirement, you need to see the full picture. And that picture isn’t complete without accounting for inflation and tax the two biggest silent factors that shape your real returns.

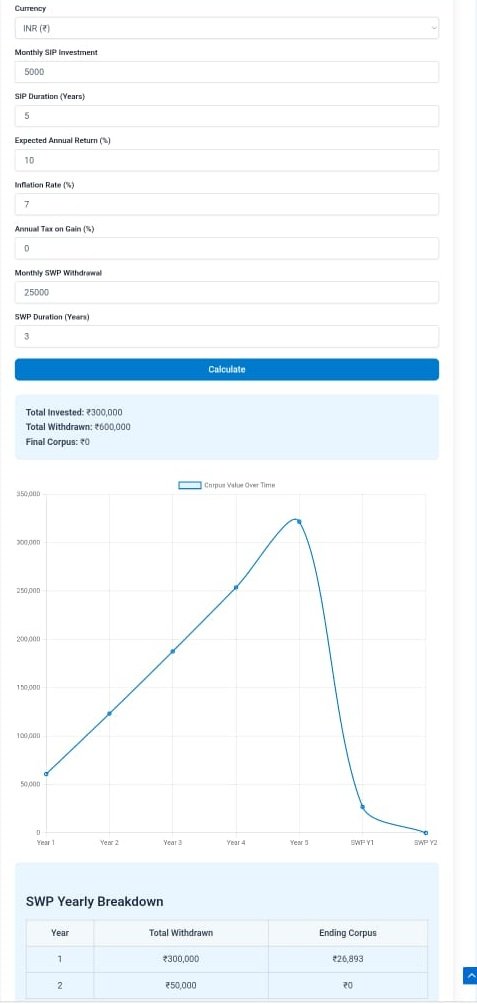

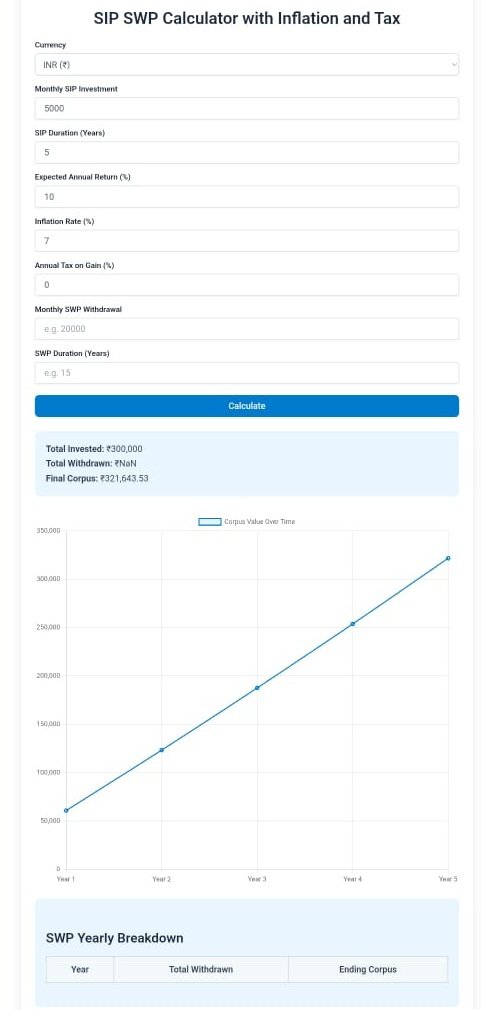

SIP SWP Calculator with Inflation and Tax

Note : We have tried this calculator and more that 100+ user, and it is working well. This calculator is for for your comfort and ease. While taking any financial efforts asked the professionals

SIP SWP Calculator with Inflation & Tax / sip + swp calculator

Total Time: 2 minutes

Choose your currency (INR ₹, USD $, etc.)

Enter your SIP Details (Investment Phase)

1. How much will you invest monthly?

2. For how many years will you invest?

3. What’s the expected return per year (%)?

4. What inflation rate do you want to consider?

Switch to SWP Details (Withdrawal Phase)

1.How much corpus (final amount) do you expect after SIP?

2. How much do you want to withdraw monthly?

3. What return will your money earn during withdrawal years?

4.What’s the inflation rate during retirement?

5.What tax rate applies to your capital gains?

Click on the “Calculate” button, you will get Output

How much your SIP investment will grow into

How long your monthly withdrawals will last

How inflation affects your monthly income

How much tax you’ll pay over time

A simple graph of how your funds rise and fall

What is SIP to SWP? A Guide for 2025 Retirement Planning in India

In today’s volatile economy, a SIP to SWP strategy is essential for Indian investors aiming for financial independence. Systematic Investment Plan (SIP) lets you invest fixed amounts (e.g., ₹5,000-₹50,000 monthly) in mutual funds, leveraging rupee cost averaging for long-term growth. Once your corpus matures—say, after 15-25 years—you switch to Systematic Withdrawal Plan (SWP) for regular, tax-efficient payouts.

But here’s the catch: Without adjustments, 6% inflation (RBI’s Nov 2025 projection) erodes your real returns by 40% over 20 years, while 12.5% LTCG tax on equity gains (post-2025 Budget exemption up to ₹1.25L) shrinks take-home income. Our SIP SWP calculator India 2025 solves this by modeling hybrid scenarios: Build ₹1Cr corpus via SIP at 12% returns, then withdraw ₹50,000/month via SWP lasting 25+ years post-inflation and tax.

- SIP Phase: Step-up investments (5-10% annually) to match salary hikes and outpace inflation.

- SWP Phase: Flexible withdrawals from equity/debt funds, minimizing tax via indexation.

- Key 2025 Tip: With Budget hikes, prioritize ELSS funds for 80C deductions during SIP buildup.

2025 SIP-SWP Strategies Post-Budget Tax Changes: Beat Inflation with Step-Ups

The 2025 Union Budget raised LTCG to 12.5% but hiked exemptions—good news for SWP users! Yet, inflation at 5.5-6% (per RBI’s latest) demands proactive planning. Use our inflation and tax adjusted SIP to SWP tool to test strategies:

| Strategy | SIP Input (₹/month, 20 yrs) | Corpus (Post-Inflation/Tax) | SWP Duration (₹50K/month) |

|---|---|---|---|

| Basic SIP (No Step-Up) | ₹10,000 @12% returns | ₹80L real value | 18 years |

| Step-Up SIP (8% annual) | ₹10,000 escalating | ₹1.2Cr real value | 25 years |

| Hybrid with Debt SWP | ₹15,000 @10% returns | ₹95L real value | 22 years (30% slab tax) |

Example: A 35-year-old invests ₹15,000/month in equity SIPs. By 60, corpus hits ₹2.5Cr nominal—but our calculator shows ₹1.8Cr inflation-adjusted after 6% CPI. SWP at 4% rate yields ₹75,000/month post-12.5% tax, sustainable for 30 years. Download Excel for custom tweaks!

Pro Tip for 2025: Integrate NPS for additional tax breaks. Link to our standalone SWP calculator for deeper withdrawal simulations.

How Inflation and Tax Impact Your SIP-SWP Corpus

Inflation compounds silently: ₹1 today buys 50% less in 20 years at 6%. Taxes add friction—equity SWP treats withdrawals as capital gains (STCG 20% if <1yr, LTCG 12.5% after). Our tool auto-calculates: Input your slab (10-30%), and see net income drop by 15-25%. Real-world: On ₹1Cr corpus, unadjusted SWP lasts 20 years; adjusted, 28 years.

Compare with competitors: Unlike basic Groww tools, ours includes step-ups and 2025 tax slabs for accurate mutual fund retirement planning.

How to Use the SIP-SWP Calculator India 2025: Step-by-Step Guide

- Enter SIP details: Monthly amount, duration (e.g., 20 years), expected returns (10-15% for equities).

- Add step-up % (0-10%) and inflation rate (5.5% default for Nov 2025).

- Switch to SWP: Input withdrawal rate, tax slab, and fund type (equity/debt).

- View results: Graph, table, total tax paid—export to Excel for ITR filing.

Bonus: Simulate 2025 scenarios like “What if returns dip to 8% post-election volatility?”

Try other Calculator :

For more information and SIP and SWP, Check the Article.

SIP and SWP Calculator with Inflation

When it comes to wealth building and financial independence, two strategies stand out: SIP and SWP. Most people know them by their full forms Systematic Investment Plan (SIP) and Systematic Withdrawal Plan (SWP). But where many go wrong is ignoring one silent but powerful factor, inflation. That’s why a SIP and SWP calculator with inflation is more important than ever before.

If you’re wondering how to calculate SIP returns with inflation, or how to convert SIP to SWP later for monthly income, this guide is for you. It will help you understand the journey from investment to withdrawal with real numbers, all while adjusting for the rising cost of living.

What is SIP and Importance of SIP

A SIP or Systematic Investment Plan, allows you to invest a fixed amount regularly in mutual funds. It’s like putting money on autopilot. You don’t have to time the market. Just keep investing every month, and let compounding do the heavy lifting.

But The value of the money you are investing today will be different 10 or 20 years down the line. ₹10,000 today won’t buy the same things in 2045. That is where the sip calculator with inflation comes in. It shows not just the future value of your investment, but also how much that future amount is worth in today’s terms. This helps you set realistic goals.

SIP Calculator with Inflation

I tried step up sip calculator, here is the result, and how i used it.

For example: You invest ₹10,000/month for 20 years, expecting a 12% annual return.

Without inflation, the SIP calculator shows your investment grows to around ₹98 lakhs.

But now let’s factor in 6% inflation. The real value of that ₹98 lakhs is much lower closer to ₹30– 35 lakhs in today’s money. That’s a massive difference.

A SIP calculator with inflation rate adjustment helps you….

- Set realistic retirement or education goals

- Understand purchasing power in the future

- Avoid overestimating your wealth

How SIP Becomes SWP

You invest through SIP in your working years. But once you retire, you want to withdraw money regularly. That’s where SWP comes in.

An SWP lets you withdraw a fixed sum monthly or quarterly from your mutual fund investment. It’s like creating a salary for yourself post retirement. But again, that monthly ₹40,000 withdrawal won’t be enough after 10 years due to inflation.

You need a sip swp calculator with inflation to…

- Understand how long your money will last

- Adjust monthly withdrawals to match rising costs

- Factor in both investment returns and taxes

How SIP and SWP Calculator together

One calculator for SIP and another for SWP? What you need is a SIP and SWP calculator together one that tracks the entire cycle, just use step up sip calculator then you can add SWP numbers to get both condition result.

- You enter your SIP values (amount, duration, return, inflation)

- Then switch to SWP mode post retirement (monthly withdrawals, step up rate, inflation)

This unified view shows:

- How much corpus you’ll build with SIP

- How long that corpus will last under SWP

- How inflation eats into both stages.

Step Up SIP and SWP Adjusting for Growth

A great strategy to beat inflation is the step-up SWP and SIP feature. With a step-up SIP, you increase your monthly investment every year , by 10%. This way, as your income grows, your investments do too.

So a step-up SWP calculator lets you plan withdrawals that increase every year to match inflation. So, if you start with ₹50,000/month, it grows to ₹53,000 next year, and so on.

SIP Calculator Excel Free Download

Many people search for sip swp calculator Excel free download to get offline tools. These are useful for basic planning, especially if you like tweaking numbers in spreadsheets. But if you want dynamic visuals, auto-adjustments for inflation, and easier comparisons, online calculators like those at calculateonline are more powerful and user friendly.

Why Inflation Adjusted SIP and SWP Calculators Matter

To sum it up, a Best SIP SWP calculator that adjusts for inflation does much more than give fancy graphs.

- Brings your future goals to today’s scale

- Helps plan for healthcare, rent, food, and other costs rising yearly

- Prevents the trap of over saving or under saving

In India, where inflation can swing between 5% to 7%, this isn’t optional it’s essential.

Whether you’re investing for your child’s education, a new home, or your retirement dreams, always use a sip and swp calculator with inflation. It’s the closest thing you have to a financial crystal ball showing not just how much you’ll have, but how far it’ll actually take you.

FAQs

What is sip swp calculator with inflation and tax in India

A SIP SWP Calculator with Inflation & Tax shows how your monthly investments grow and how long they’ll last when you start withdrawing. It factors in inflation to adjust future income to today’s value and includes tax impact on returns. This gives you a clearer, more realistic plan for your retirement or financial goals.

What is inflation rate in sip calculator

The inflation rate in a SIP calculator adjusts your investment’s future value to reflect real world purchasing power. It helps you see how much your returns will actually be worth after rising prices. This gives a more accurate picture of your financial goals over time.

sip calculator with inflation and tax

A SIP calculator with inflation and tax helps you estimate your real returns after adjusting for rising prices and applicable taxes. It gives a more accurate picture of your future wealth. Try it here: SIP SWP Calculator with Inflation & Tax.

What is adjusted for inflation in sip calculator

Adjusted for inflation in a SIP calculator means your future investment value is shown in today’s money, giving you a clearer idea of what your returns will actually be worth after accounting for rising prices over time.

What is the best SIP to SWP strategy for 2025 in India?

Start with 5-10% step-up SIP in equity funds for 15-20 years, then SWP at 4% rate. Our tool shows: ₹20K/month yields ₹2Cr corpus, lasting 28 years post-6% inflation and 12.5% tax. Ideal for 30% slab earners.

How does 2025 Budget affect SIP-SWP tax?

LTCG now 12.5% on gains >₹1.25L (up from 10%), but indexation removed for debt. Use equity SWPs to minimize—calculator factors your slab for net projections.

Can I download Excel from the SIP SWP calculator?

Yes! Export year-by-year data for corpus, withdrawals, and taxes. Perfect for 2025 ITR or advisor reviews.

What is the inflation rate for SIP SWP 2025 planning in India?

For SIP SWP calculator India 2025, use RBI’s projected CPI inflation of 2.6% for FY26, down from earlier 3.1% estimates amid softening food prices.

SIP vs SWP returns comparison: Which is better for 2025 India investors?

In SIP SWP calculator India 2025 comparisons, SIP excels in accumulation (e.g., ₹15K/month at 12% yields ₹2.5Cr over 20 years pre-inflation), while SWP shines in decumulation (4% rate on ₹1Cr corpus delivers ₹4L/year post-12.5% LTCG tax, lasting 25 years). SIP builds via rupee-cost averaging against volatility; SWP provides steady income with tax efficiency on equity gains. Our inflation and tax adjusted SIP to SWP tool reveals: Hybrid approach nets 8-10% real returns vs. 6% standalone. For 2025, post-RBI 2.6% forecast, prioritize SIP for growth phase, SWP for retirement—avoid lump-sum risks. Download Excel for side-by-side projections in mutual fund retirement planning. (98 words)

How to use step-up SIP for beginners in 2025 SWP planning?

Step-up SIP in SIP SWP calculator India 2025 is beginner-friendly: Auto-increase investments 5-8% annually to match salary hikes and beat 2.6% RBI inflation.

Debt vs equity tax in SIP SWP calculator India 2025: Key differences?

For debt vs equity in SIP SWP calculator India 2025, equity offers LTCG at 12.5% on gains >₹1.25L (post-Budget perk, no indexation loss), ideal for long-hold SWP—e.g., ₹1Cr corpus yields ₹50K/month with 10% effective tax. Debt faces 30% flat tax on interest (or slab rate), eroding returns in high-inflation scenarios like RBI’s 2.6% FY26 forecast.

Common mistakes in SIP to SWP strategy for 2025 India retirement?

Avoid pitfalls in SIP SWP calculator India 2025: Ignoring 2.6% inflation leads to 30% corpus erosion over 20 years—always adjust via our tool.

How to integrate NPS with SIP SWP calculator India 2025 for better returns?

Integrate NPS in SIP SWP calculator India 2025 for tax-advantaged boosts: Allocate 20% of SIP to NPS Tier-I (₹50K extra 80CCD(1B) deduction), yielding 9-11% annuity-linked returns pre-inflation. Post-accumulation, blend NPS SWP (60% lump-sum tax-free) with mutual fund SWP for diversified income—e.g., ₹1Cr total corpus at 2.6% RBI inflation sustains ₹60K/month for 30 years after 12.5% LTCG.

Unlock Your 2025 SIP-SWP Plan: Free Guide

Get our PDF on “Inflation-Proof Retirement: Post-Budget Tips.” Enter email below.