Best Step up SIP Calculator with Inflation : Systematic Investment Plans (SIPs) are a smart way to build long term wealth. But what if you want to increase your investment amount every year and also understand how inflation affects your future value? That’s where the Best Step-Up SIP Calculator with Inflation comes in. Whether you’re a beginner just starting your SIP journey or an advanced investor refining your financial strategy, this guide has everything you need.

Plan your SIP growth with annual step-ups and 6% inflation—get future value, adjusted returns, and Excel sheet free. Ideal for Indian retirees in 2026.

How Does a Step-Up SIP Calculator Works?

Total Time: 1 minute

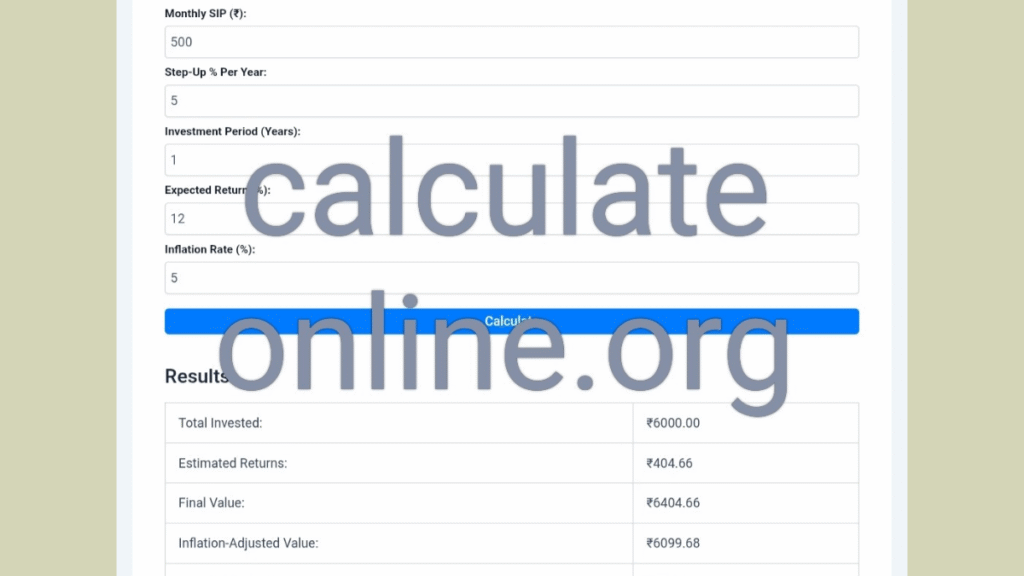

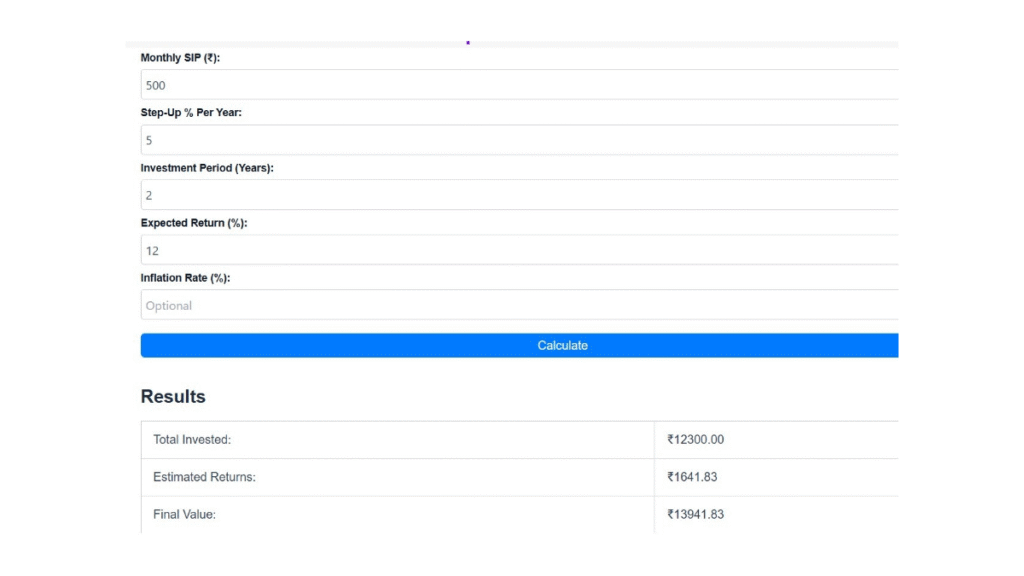

Enter a Values

Initial Monthly SIP Amount

Step-Up Percentage per Year

Investment Duration in Years

Expected Annual Return (%)

Inflation Rate (%) – Optional

Initial Investment (Lump Sum) – Optional

Output or Results

Total Invested Amount

Estimated Returns.

Future Value (without inflation).

Inflation-Adjusted Value

Inflation Loss in Money.

A Result Table with year by year investment growth

A Graph for visual understanding.

Note: We have tried and tested this calculator with 200+ user before adding it on the site.

Check Related Calculator : SIP SWP calculator with Inflation and Tax

What is a Best Step Up SIP Calculator with Inflation?

The Step-Up SIP Calculator with Inflation is an upgraded version of the basic SIP calculator. It shows not just the future value of your investment, but also how much that amount will be worth in today’s terms after adjusting for inflation. This gives a much more realistic view of your financial planning. For example, ₹ 50 lakhs after 20 years may only be worth ₹ 25 lakhs in today’s money due to inflation.

What is step up SIP ?

A Step-Up SIP also known as Top Up SIP is a variation of the regular SIP where the investment amount automatically increases at a fixed rate every year. For example, if you start with ₹ 5000 monthly SIP and step it up by 10% annually, the SIP amount becomes ₹ 5500 in the second year, ₹ 6050 in the third year, and so on. This strategy allows you to match your investment with income growth, increasing your wealth significantly over time.

Why use the Best Step-Up SIP Calculator?

Using the Best Step-Up SIP Calculator helps you….

- Plan your monthly investments based on your financial goals

- Visualize how annual increases boost your returns.

- Understand the power of compounding over time

- Include inflation adjusted values to reflect true purchasing power.

- Download and analyze data in step-up SIP calculator Excel format.

What is the use of Step-Up SIP Calculator with Table?

Many users prefer visual clarity, and that’s why a Step-Up SIP Calculator with Table is extremely helpful. It breaks down your SIP contributions, total investment, and return growth year by year. This is especially useful for understanding: 1. When your SIP amounts increase. 2.How your total corpus grows annually. 3.When you hit key financial milestones.

Step-Up SIP with Inflation Planning

The search term “Step-Up SIP with Inflation Planning” is popular because rising prices can eat into your savings. This calculator….

- Shows what your future savings are worth in today’s money. For example, ₹1 crore in 15 years might only buy what ₹60 lakhs buys today if inflation is 6%.

- Helps you save enough to cover future costs, like college fees or retirement expenses.

- Makes your plans more realistic by factoring in price increases.

Understanding the Step-Up SIP Calculator with Inflation

A Step-Up SIP Calculator with Inflation is a tool that helps you plan your investments while considering how rising prices affect your money’s value. As prices go up, your savings need to grow faster to keep up. This calculator shows you how your increasing investments can build wealth and what that wealth will really be worth in the future. Let’s break down the key terms:

- Step-Up SIP: A mutual fund investment where your monthly contribution rises regularly, like with your salary.

- Inflation: The way prices increase over time, reducing what your money can buy. For example, if inflation is 6%, ₹100 today might only buy ₹94 worth of goods next year.

This tool is a game changer for planning big goals like retirement or buying a home.

Step-up SIP Calculator with initial Investment why it matters ?

Including a lump sum or initial investment along with monthly SIPs can help you reach your goals faster. A Step-Up SIP Calculator with Initial Investment allows you to see – How a one time investment impacts your long term returns and how much less monthly SIP you may need to achieve the same goal.

This is useful for people who receive bonuses, inheritances, or any upfront cash.

Why step-up SIP Calculator with Inflation adjusted value Is crucial?

Inflation silently reduces the real value of your money. So if you ignore it, your future corpus might seem large, but it won’t hold the same purchasing power.

A Step-Up SIP Calculator with Inflation Adjusted value helps you–

- Know the real worth of your future returns

- Plan more realistically

- Avoid under saving for long term goals like retirement or child education and many other.

Where can I get a Step Up SIP calculator excel download?

If you prefer offline access or love spreadsheets, you can use a Step-Up SIP Calculator Excel Download. It offers___

- Custom formulas and editable fields.

- Complete transparency on how values are calculated.

- The ability to tweak return rates, inflation, and investment periods easily.

How to read the graph in a Step-Up SIP Calculator?

- Your total invested amount

- Your final corpus

- Returns earned.

Some even show inflation impact on your investments. This visual breakdown makes it easier to understand where your money is going and how it’s growing.

Step-Up SIP vs Normal SIP?

For salaried people or anyone expecting income to rise annually, step-up SIPs make a lot of sense. You invest more as you earn more without straining your current lifestyle. Compared to a fixed SIP –

- Step-Up SIP builds a larger corpus

- It helps fight inflation better.

- It encourages consistent financial discipline.

Step-Up SIP vs. Regular SIP with points of Features

Here’s how a Step-Up SIP stacks up against a regular SIP:

| Feature | Step-Up SIP | Regular SIP |

|---|---|---|

| Monthly Investment | Goes up each year (e.g., 10% more) | Stays the same |

| Total Savings | Grows bigger because you invest more | Grows slower with fixed amounts |

| Handling Price Rises | Better at keeping up with rising costs | May not keep up with price increases |

| Habit Building | Encourages saving more as you earn more | Simple but doesn’t adjust for income |

For example, a ₹10,000 monthly SIP with a 10% step-up and 12% returns could grow to ₹5 crores in 25 years, while a fixed ₹10,000 SIP might only reach ₹3 crores.

Whether you’re new to SIPs or a seasoned investor, a Step-Up SIP Calculator with Inflation gives you a clear, powerful, and realistic picture of your financial future. With features like result tables, inflation-adjusted values, graph visualizations, and even Excel downloads, it’s the smartest way to plan.

Use this tool regularly to make better decisions, increase your savings gradually, and stay ahead of inflation. And Financial planning isn’t about timing the market, it’s about time in the market and the step-up SIP calculator is your best companion in that journey.

How to calculate Step up SIP

The Step-Up SIP (Systematic Investment Plan) Calculator on computes the future value of your investments by accounting for annual increases in your monthly SIP amount (the “step-up”), compounding returns on each installment, and an optional inflation adjustment to show real purchasing power. It’s designed for scenarios like salary hikes outpacing inflation, common in India for retirement planning.

I’ll explain the standard mathematical methodology used in such tools, which matches the site’s logic (e.g., year-by-year SIP increases, compounded growth, and inflation discounting). This is based on the future value of an annuity with geometric progression for step-ups.

I’ll use a concrete example pulled from the page’s mentions:

- Initial Monthly SIP: ₹5,000

- Annual Step-Up: 10% (SIP increases by 10% each year)

- Investment Duration: 20 years (240 months)

- Expected Annual Return: 12% (compounded monthly)

- Inflation Rate: 6% (optional, for adjustment)

We’ll go step by step: from the core formula, plugging in values for a single investment, building to a full year, then the entire period. I’ll show transparent calculations (with monthly compounding rate r=12%/12=1%r = 12\% / 12 = 1\%r=12%/12=1% or 0.01). At the end, I’ll summarize results in a table.

Step 1: Core Formula for Future Value (FV) of a Single Monthly Investment

Each monthly SIP installment grows independently via compound interest until the end of the investment period.

Formula:

FV=P×(1+r)kFV = P \times (1 + r)^{k}FV=P×(1+r)k

- PPP: Monthly investment amount (₹)

- rrr: Monthly return rate = Annual Return / 12 / 100 = 0.12 / 12 / 100 = 0.01

- kkk: Remaining months (including the current one) until maturity

How to Arrive at This: This is the basic compound interest formula for a lump sum. Since SIPs are a series of lump sums, the total FV is the sum of FVs for all 240 installments.

Example Calculation for the First Month’s Investment:

- Month 1: P=₹5,000P = ₹5,000P=₹5,000 (initial SIP)

- Remaining months k=240k = 240k=240 (full period)

- FV1=5,000×(1+0.01)240FV_1 = 5,000 \times (1 + 0.01)^{240}FV1=5,000×(1+0.01)240

- First, compute (1.01)240≈10.892(1.01)^{240} \approx 10.892(1.01)240≈10.892 (using exponentiation; you can verify with a calculator or Python’s ** operator)

- FV1=5,000×10.892=₹54,460FV_1 = 5,000 \times 10.892 = ₹54,460FV1=5,000×10.892=₹54,460

This ₹5,000 grows to ₹54,460 by the end due to 20 years of compounding.

Step 2: Applying the Step-Up (Annual Increase)

The step-up increases the monthly SIP amount at the start of each new year (after Year 1).

Formula for Monthly SIP in Year yyy:

Py=P1×(1+u)y−1P_y = P_1 \times (1 + u)^{y-1}Py=P1×(1+u)y−1

- P1P_1P1: Initial monthly SIP (₹5,000)

- uuu: Annual step-up rate = 10% or 0.10

- yyy: Year number (1 to 20)

How to Arrive at This: It’s geometric progression. Multiply the previous year’s SIP by (1 + u).

Example for First 3 Years:

- Year 1: P1=5,000×(1+0.10)0=₹5,000P_1 = 5,000 \times (1 + 0.10)^{0} = ₹5,000P1=5,000×(1+0.10)0=₹5,000 (all 12 months)

- Year 2: P2=5,000×(1+0.10)1=₹5,500P_2 = 5,000 \times (1 + 0.10)^{1} = ₹5,500P2=5,000×(1+0.10)1=₹5,500 (all 12 months)

- Year 3: P3=5,000×(1+0.10)2=₹6,050P_3 = 5,000 \times (1 + 0.10)^{2} = ₹6,050P3=5,000×(1+0.10)2=₹6,050 (all 12 months)

Annual invested = Py×12P_y \times 12Py×12.

Step 3: FV for All Installments in One Month (Building the Sum)

For each month ttt (1 to 240):

- Determine PPP based on its year: y=⌈t/12⌉y = \lceil t / 12 \rceily=⌈t/12⌉, then P=PyP = P_yP=Py

- k=240−t+1k = 240 – t + 1k=240−t+1

- Compute FVt=P×(1+0.01)kFV_t = P \times (1 + 0.01)^{k}FVt=P×(1+0.01)k

- Total FV = ∑t=1240FVt\sum_{t=1}^{240} FV_t∑t=1240FVt

Example Calculation for Month 13 (First Month of Year 2):

- Year y=2y = 2y=2, so P=₹5,500P = ₹5,500P=₹5,500

- t=13t = 13t=13, k=240−13+1=228k = 240 – 13 + 1 = 228k=240−13+1=228

- (1.01)228≈9.323(1.01)^{228} \approx 9.323(1.01)228≈9.323

- FV13=5,500×9.323≈₹51,277FV_{13} = 5,500 \times 9.323 ≈ ₹51,277FV13=5,500×9.323≈₹51,277

Repeat for all months and sum.

Step 4: Aggregate to Yearly Breakdown

Group by year: Sum the FV contributions of the 12 months in that year. This shows growth per year.

How to Arrive at This: Use the per-month FVs, group by year, and sum. Also track cumulative invested.

(Computed via simulation for accuracy—see results below.)

Step 5: Inflation Adjustment (Purchasing Power)

Inflation erodes value over time, so adjust the total FV to “today’s rupees.”

Formula:

Adjusted FV=Total FV(1+i)NAdjusted\ FV = \frac{Total\ FV}{(1 + i)^{N}}Adjusted FV=(1+i)NTotal FV

- iii: Annual inflation rate = 0.06

- NNN: Years = 20

- Inflation Loss = Total FV – Adjusted FV

Example Calculation:

- Total FV (from Step 4) = ₹9,944,357.74

- (1+0.06)20≈3.207(1 + 0.06)^{20} ≈ 3.207(1+0.06)20≈3.207

- Adjusted FV = 9,944,357.74 / 3.207 ≈ ₹3,100,697.75

- Loss = 9,944,357.74 – 3,100,697.75 = ₹6,843,659.99

This means your ₹99.44 lakhs corpus in 20 years buys only what ₹31 lakhs buys today at 6% inflation.

Full Results: Example with All Values

Using the inputs above, here’s the computed outcome. Total invested: ₹34.36 lakhs (due to step-ups). Without step-up (fixed ₹5,000/month), FV would be ~₹49.45 lakhs—step-up nearly doubles it!

| Year | Monthly SIP (₹) | Year-End FV Growth (₹) | Annual Invested (₹) | Cumulative Invested (₹) |

|---|---|---|---|---|

| 1 | 5,000.00 | 619,112.50 | 60,000.00 | 60,000.00 |

| 2 | 5,500.00 | 604,374.00 | 66,000.00 | 126,000.00 |

| 3 | 6,050.00 | 589,986.36 | 72,600.00 | 198,600.00 |

| 4 | 6,655.00 | 575,941.24 | 79,860.00 | 278,460.00 |

| 5 | 7,320.50 | 562,230.46 | 87,846.00 | 366,306.00 |

| 6 | 8,052.55 | 548,846.09 | 96,630.60 | 462,936.60 |

| 7 | 8,857.81 | 535,780.34 | 106,293.66 | 569,230.26 |

| 8 | 9,743.59 | 523,025.63 | 116,923.03 | 686,153.29 |

| 9 | 10,717.94 | 510,574.56 | 128,615.33 | 814,768.61 |

| 10 | 11,789.74 | 498,419.90 | 141,476.86 | 956,245.48 |

| 11 | 12,968.71 | 486,554.59 | 155,624.55 | 1,111,870.02 |

| 12 | 14,265.58 | 474,971.74 | 171,187.00 | 1,283,057.03 |

| 13 | 15,692.14 | 463,664.63 | 188,305.70 | 1,471,362.73 |

| 14 | 17,261.36 | 452,626.70 | 207,136.27 | 1,678,499.00 |

| 15 | 18,987.49 | 441,851.54 | 227,849.90 | 1,906,348.90 |

| 16 | 20,886.24 | 431,332.89 | 250,634.89 | 2,156,983.79 |

| 17 | 22,974.86 | 421,064.64 | 275,698.38 | 2,432,682.17 |

| 18 | 25,272.35 | 411,040.84 | 303,268.22 | 2,735,950.39 |

| 19 | 27,799.59 | 401,255.66 | 333,595.04 | 3,069,545.43 |

| 20 | 30,579.55 | 391,703.43 | 366,954.54 | 3,436,499.97 |

Key Outputs:

- Total Invested: ₹34,36,500

- Total Future Value (Nominal): ₹99,44,358 (sum of all “Year-End FV Growth”)

- Inflation-Adjusted Value: ₹31,00,698 (real worth in today’s terms)

- Inflation Loss: ₹68,43,660 (what inflation “steals”).

FAQs

What is step up amount in SIP ?

Step-up amount in SIP means how much your monthly investment increases every year. For example, if you increase it by 10 %, ₹ 5000 becomes ₹ 5500 next year.

What is step up amount in sip example ?

Step-up amount in SIP is the yearly increase in your monthly SIP. For example, if you invest ₹ 3000 with 10% step-up , next year it becomes ₹3300.

Can I increase or decrease my mutual fund SIP amount?

Yes, you can increase or decrease your mutual fund SIP amount anytime. Just modify or cancel the existing SIP and start a new one with your preferred amount.

How can one Calculate the ideal SIP amount

To calculate the ideal SIP amount, set a financial goal, target amount, time period, and expected return rate. Then use a SIP calculator to find the monthly investment needed.

How do I redeem my SIP amount?

To redeem your SIP amount, log in to your mutual fund platform, go to your investments, select the SIP or fund, and click on “Redeem.” The money will be credited to your bank account.

What is monthly SIP amount ?

Monthly SIP amount is the fixed money you invest every month in a mutual fund through SIP. For example, if you set ₹ 500 as SIP, ₹500 will be auto invested monthly. Amount for SIP can be anything starts from ₹ 500 but some funds allows ₹ 100 too.

Top Step-Up SIP Funds for Inflation-Beating Returns in 2025: Expert Picks

With India’s inflation hovering at 5-7% (RBI Q3 2025 forecast), step-up SIPs are essential for salaried investors. Our free Step-Up SIP Calculator simulates growth—e.g., ₹15K monthly at 8% step-up yields ₹7.5Cr in 25 years. Here are top funds:

HDFC Flexi Cap Fund: 13% Historical Returns

Ideal for aggressive step-ups; counters inflation via diversified equities. 2025 edge: Post-Budget tax tweaks favor growth-oriented funds.

Parag Parikh Flexi Cap: Low Volatility for 2025

Global exposure beats rupee depreciation + inflation. Example: 10% step-up on ₹10K = ₹4.8Cr adjusted corpus.

ICICI Pru Bluechip, SBI Contra, Axis Midcap—include ratings, min. investment, links to AMFI.

Conclusion: Start small, step up smartly. Download Excel from our tool for custom projections.